Slow, Averaging and Denial

Delays in claims processing

This is one of the five key areas where people express dissatisfaction with their insurer.

Go into any pub and may well hear a story about insurer delay. Examples are legion. Lengthy delays often occur when there is doubt about policy cover. One recent example we have had is where a business interruption claim is tied to physical damage at the premises, which the client chose not to insure. The policy wording is key and, in this example does not exclude property that could have been insured but was not.

It is more common that you might imagine that the claims people do not actually know the scope of cover of their own policy.

Averaging, reduced payment

Very much like delay, in that lots of people have stories. Sometimes circumstances conspire. A friend had a theft claim for a very expensive car declined as a special alarm was not fitted, any oversight of the garage, who had subsequently gone out of business, left him high and dry.

The most common cause of a reduced payment is averaging. Under declaring insured values is very tempting, but ultimately a false economy.

Denial, Policy Wording

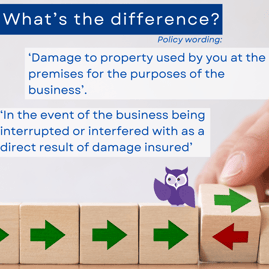

So, what’s the difference between these wordings from two common commercial property policies about business interruption cover:

1. 'Damage to property used by you at the premises for the purposes of the business'

2. 'In the event of the business being interrupted or interfered with as a direct result of damage insured'

In the case of one of our clients with a current loss, a valid claim of about £20,000.

The best cover wording was in place ensuring payout.

Why would a busy person involved in running a company and buying insurance possibly expect to know?

There is a place for professional advice, seek professional advice.